ev tax credit bill text

Sales of 2022 of Electric Vehicles continues go grow. The exceptions are Tesla and General Motors whose tax credits have been phased out.

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

A Senate version of the EV plan had initially proposed to offer an additional tax credit beyond the base 7500 of 2500 for the buyers of electric vehicles manufactured.

. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. Current EV tax credits top out at 7500.

It also would limit the EV credit to cars. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying. How much is the electric vehicle tax credit worth in 2021.

BEV PHEV SALES VEHICLES IN OPERATION. 2011-2021 EXCEL FILE. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

REFUNDABLE credit so valuable for everyone. The existing federal EV tax credit promises a dollar-for-dollar credit of up to 7500 to anyone buying an electric car in the US but there are several. Under the bill the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to 250000 for individuals and 500000 for joint filers.

The amount of the credit will vary depending on the capacity of the. 1 I N GENERALIf the credit allowable under subsection a after the application of subsection e exceeds the limitation imposed by section 26a for such taxable year reduced by the sum of the credits allowable under this subpart other than subsection a of this section such excess shall be carried to the succeeding taxable year and treated as a. Heres how you would qualify for the maximum credit.

House Nov 20 bill MSRP text. The tax credit would last for five years once the Build Back Better plan is passed by the US. Add an additional 4500 for EVs assembled in the US using.

The EV tax credit has traditionally only applied to new cars but this bill provides up to 2500 credit for used EVs with at least a 10 kWh battery although the credit cannot. The nearly 2 trillion in spending includes a much-talked-about boost for the electric vehicle tax credit from 7500 to 12500. Federal tax credit for EVs jumps from 7500 to 12500 Keep the 7500 incentive for new electric cars for 5 years.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the provisi. The current maximum tax credit is 7500 with no maximum price and currently phases out for individual automakers once they hit 200000 total EVs sold. House of Representatives and the US Senate and signed by Biden.

Uncap extend and make it available at the point of sale. 7500 EV tax credit reinstated 2500 for made 2500 for union made. Heres where we stand.

EV tax credit bill from Senate Finance Committee. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. The third bill the Electric Credit Access Ready at Sale CARS Act of 2018 was introduced by seven Democratic.

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. But the Build Back. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount.

On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few. The electric vehicle tax credit hasnt changed for the past three years. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a.

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Under the bill individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers to get the new EV tax credit. If the Build Back Better bill passes both the House and Senate it will make the EV tax credit refundable which would put at least 4000 and up to 12000 back in buyers pockets.

On Thursday the White House announced. EV HYBRID SALES BY STATE. Its inclusion comes as the bill sheds multiple.

Senate Finance Committee Approves 12500 EV Tax Credit Bill. The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. The credit ranges from 2500 to 7500.

2011-2021 EXCEL FILE.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

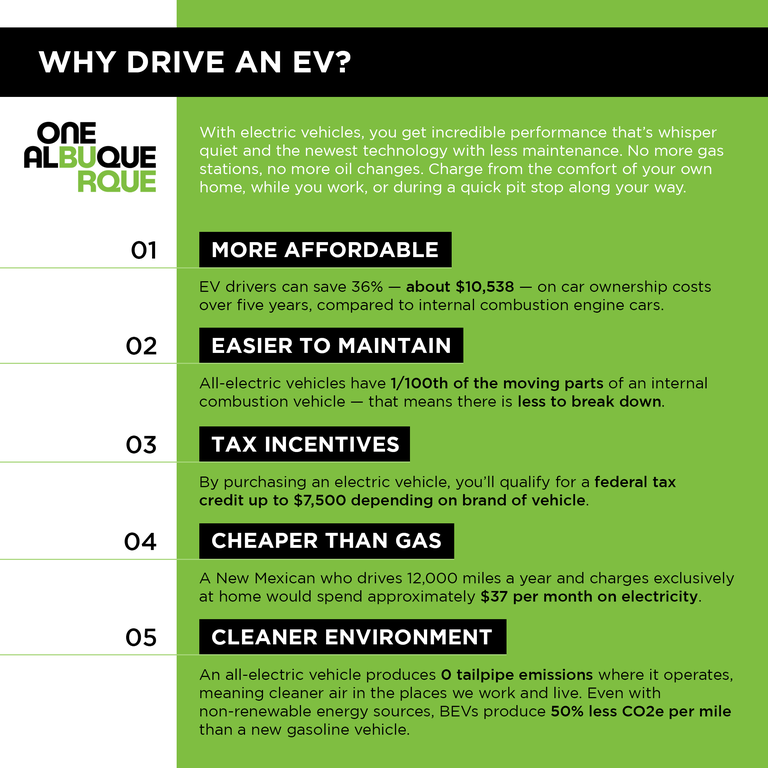

Why Drive An Electric Vehicle Ev City Of Albuquerque

Latest On Tesla Ev Tax Credit March 2022

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopEVResistanceReasons.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

Oil Industry Cons About The Ev Tax Credit Nrdc

Electric Vehicles Guide To Chinese Climate Policy

How To Calculate The Federal Tax Credit For Electric Cars Greencars

How Electric Vehicle Tax Credits Work

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Electric Vehicle Tax Credits Rebates Snohomish County Pud

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Oil Industry Cons About The Ev Tax Credit Nrdc

Southern California Edison Incentives

Nissan Ariya And Leaf Will Coexist Two Evs Well Under 40 000 Thanks To Ev Tax Credit

Latest On Tesla Ev Tax Credit March 2022

Latest On Tesla Ev Tax Credit March 2022

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption